Which commodities will be worth investing in during 2023?

Despite the unstable global scene shaken by the conflict in Ukraine and the economic recession, commodities still offer an opportunity to effectively valorize your savings or smartly diversify your portfolio. The market will follow many positive trends that started in 2021 and 2022. Read today's article and discover the best opportunities you shouldn't miss.

2022 was a roller coaster, especially for investors

The returns rate was rising steadily, pushing metals like copper to record highs. In July last year, the global commodity index jumped by 33%. However, a period of turbulence followed closely, reflecting several macroeconomic changes. At the forefront was the Russian invasion of Ukraine, which immediately limited the export of vital economic and energetic raw materials, deepening their shortage caused by the COVID pandemic. Energy prices rose by 60%. Economic recession and the strong dollar caused by the policy of the US Federal Reserve subsequently caused a drop in the prices of individual commodities, primarily affecting precious metals.

What do these events tell us about the 2023 market?

Gold will get stronger

The price of gold fluctuated dynamically during the past year. The initial $2,000 per troy ounce was brought down by the conflict in Ukraine in the fourth quarter to around $1,700. The year ended at $1,845 per troy ounce.

During 2023, the price of gold will be primarily affected by the behavior of the United States central bank, which is currently trying to solve the rising inflation, with a goal of keeping it at 2%. For this reason, growth of gold prices can be assumed, but they will probably still fluctuate due to the ongoing conflict in Ukraine. For example, if Russia starts accepting payment for oil in gold, the price of the commodity can easily double. The market's optimism is also supported by the easing of the anti-COVID measures in China, which is generally one of the largest consumers in the field of commodities. This too can lead to a rapid increase in demand.

Copper will be heavily influenced by the developments of the automotive industry

Electric cars currently occupy 6% of the USA market and even 21% in China. In Europe, the share is medium-sized at around 12%; however, with the upcoming emission downsizing, it is expected to increase by 78% until 2050. And since copper is a vital part of propulsion batteries, we can expect that the increase in demand will also affect its value.

Copper was very strong during 2022, but prices experienced a sharp drop at the turn of the 2nd and 3rd quarter when China (the largest consumer of copper) closed its borders due to COVID. However, the reopening is happening just now, which brings hope to the market, which is for now drowning in a deep economic recession.

Also, keep in mind that copper has been the 3rd most used metal in the world for a very long time, which is why it has always been in high demand and is unlikely to decline even in 2023.

Iron ore will consolidate its position, the same goes for other construction metals

The value of iron ore dropped during COVID in reaction to the slowing industry sector during the lockdowns. The closure of Chinese borders brought another cold shock. However, the situation begins to ease, which was already reflected by a 12% increase in spot ore prices to $115 per ton in December last year. In the upcoming months, we expect a further increase of 3.5%, as a response to the stabilization of the construction industry.

Lithium offers great future potential

Lithium is yet another key component of electric car batteries. It has been in short supply for a long time, being heavily influenced by China's economic situation, which was proven last December when lithium prices fell by almost 8% after China announced cuts in subsidies for its energy consumers.

However, there is currently great optimism in the market, especially regarding the potential growth of the electric vehicle sector associated with the „green policy“ of the European Union.

Aluminum will continue to grow

Chinese aluminum production will continue to decline which, together with a recovering construction industry, will lead to a structural deficit and an excess of demand over supply, pushing the prices upwards.

Demand for oil will increase

Oil consumption is on the rise due to the resumption of air travel and the loosening of Chinese regulations. The World Energy Agency predicts oil prices to grow up to 100,000 barrels per day.

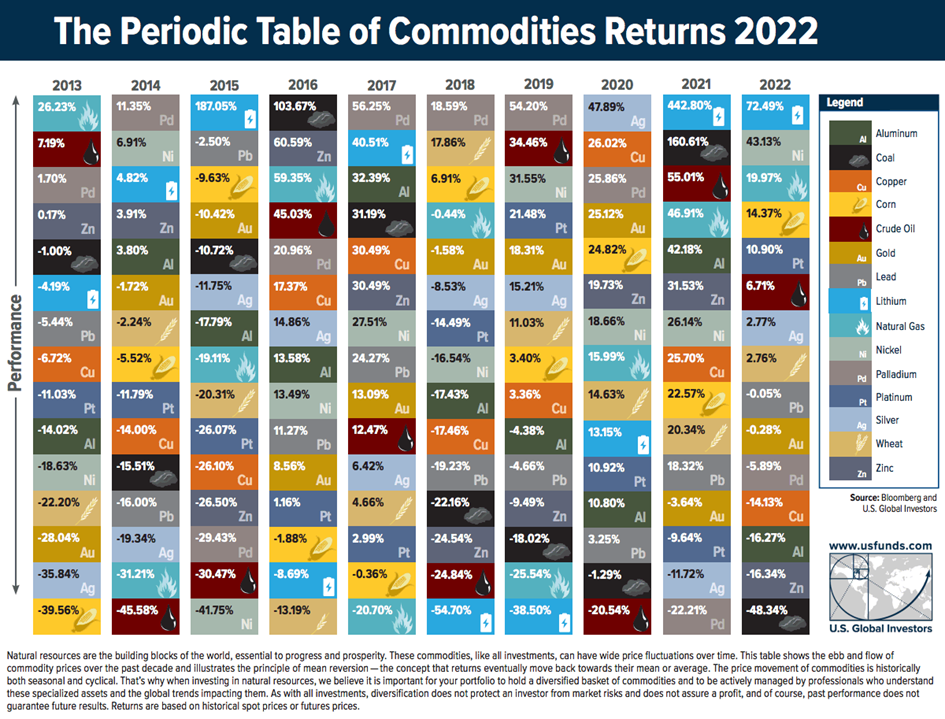

Complete information on the development of commodities in past years is shown in the following table